Today’s Topic of discussion: Impact of Nonperforming Loans on the Profitability of Banks in Bangladesh

Impact of Nonperforming Loans on the Profitability of Banks in Bangladesh

Background:

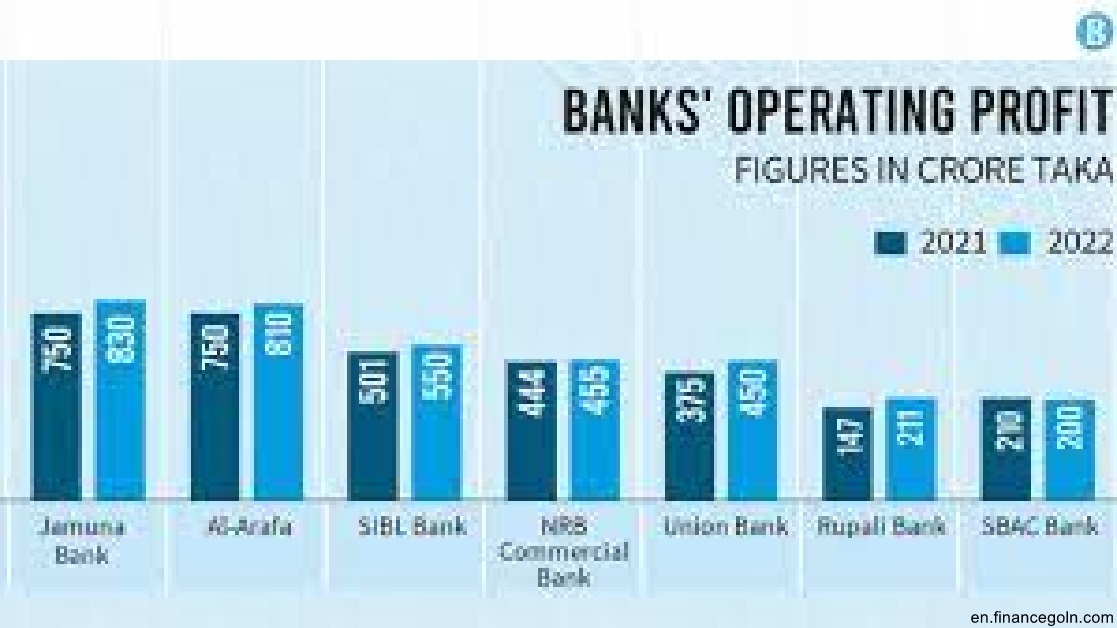

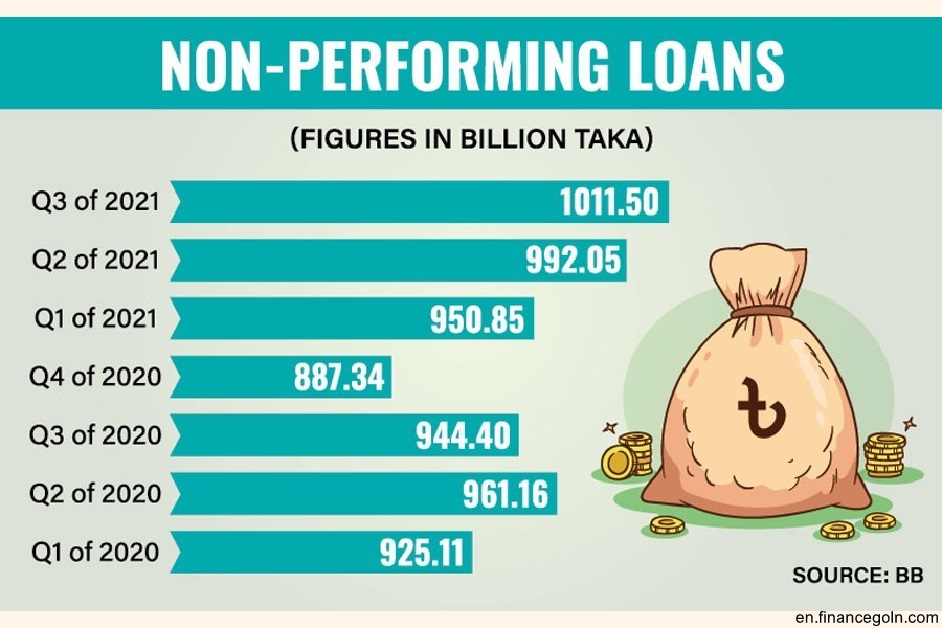

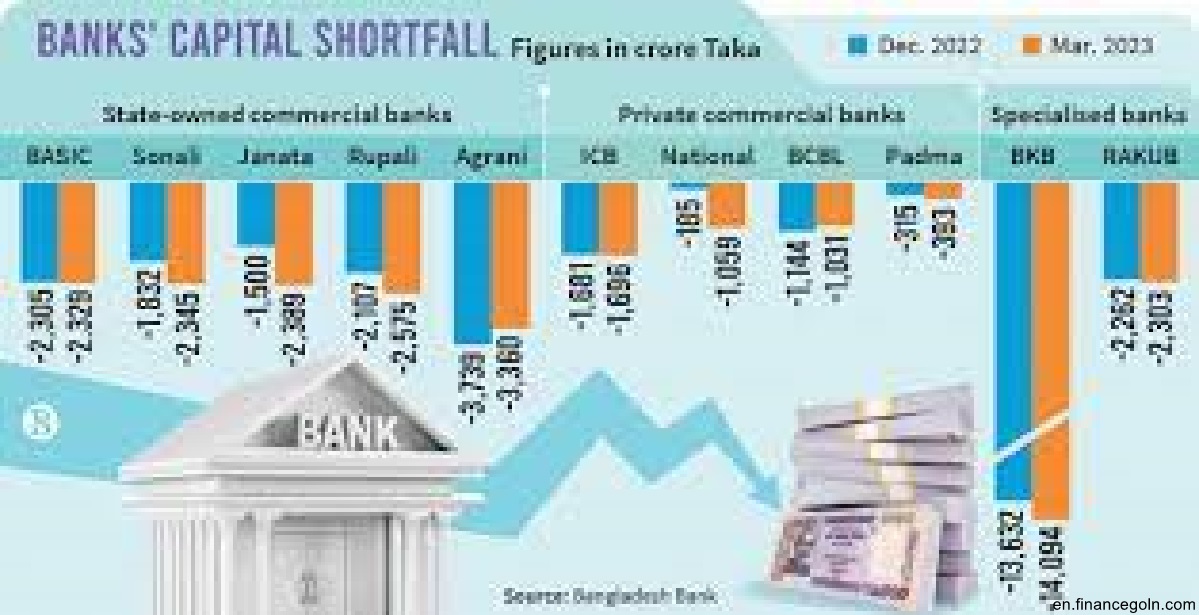

The reforming financial sector of Bangladesh is progressing towards a sustainable economy. However, some crucial factors such as nonperforming loans (NPL), high provision, and extensive credit risk are encumbering the profit growth of commercial banks. These issues are not only alarming for Bangladeshi bankers but also for global policymakers. Different measures are reinforcing the credit policy to fend off loan loss.

This thesis focuses on the NPL status of Bangladesh and global perspectives, it also scrutinizes the sector-wise loan provisioning status in the banking industry of Bangladesh.

Purpose:

To empirically investigate the impact of nonperforming loans and other determinants on the profitability of banks in Bangladesh using multiple regression models.

Methods:

This study adopted an explanatory approach and causality research design by employing balance panel data to fulfill the above purposes. This thesis completed the custom of data acquired from the financial statements and annual reports for a period of one decade (2008- 2017) of 20 commercial banks in Bangladesh.

Statistical packages like STATA, EViews, and Microsoft Excel were employed to investigate the data and to build interpretations. This study was to evaluate the effects of bank-specific factors; NPL, credit risk, loan growth, ADR, cost efficiency, bank size, and economic & industry factors on the profitability of banks in Bangladesh.

The research employed descriptive statistics, correlation analysis, and multiple regression estimation methods such as Ordinary Least Squares (OLS), Fixed Effects (FE), Random Effects (RE), and General Methods of Moments (GMM). A retrospective exploratory case study approach was also used.

Findings:

The Research findings emphasized the need for improvements in commercial banks’ management of NPL. Finally, the empirical results indicate that nonperforming loans are negatively associated with the level of profitability of banks in Bangladesh.

Conclusion:

The bank-specific factors determine nonperforming loans more than macroeconomic & industry factors in Bangladesh. It is recommended that macroeconomic policy should be directed at sustaining economic growth as it curbs nonperforming loans in the banking industry. Finally, this study explores the positive recovery trend of NPLs as a sign of improvement, mainly due to the prudent policies taken to strengthen the instruments of default loan recovery.

Description:

This dissertation was submitted to the University of Dhaka for the Degree of Doctor of Philosophy In Finance.