Today’s Topic of discussion: Lending risk analysis of the nationalized commercial banks of Bangladesh

Lending risk analysis of the nationalized commercial banks of Bangladesh

Over the last few years, the banking world has been undergoing a lot of changes due to deregulation, technological innovations, globalization, and different reforms. These changes in the banking system also brought revolutionary changes in a country’s economy. The banking sectors of Bangladesh have been reformed several times.

Recent bank failures, high occurrences of loan defaults, and bank insolvency have lighted the importance of good governance. Therefore, regulators in developing countries like Bangladesh have become more concerned about the financial health and governance of banking industry. Initiatives to reform the financial sector in Bangladesh may be traced back to the beginning of the 1980s when the denationalization of the Uttara Bank and Pubali Bank took place and several new Private Commerintensivelyeat given licenses.

Financial sector reforms started in an intensive way in the beginning of the 1990s under the Financial Sector Adjustment Credit (FSAC) which Bangladesh contracted with the World Bank.

To make the banking system competitive, effective, and international standard, the policy-making institutions of Bangladesh adopted different measures and initiatives, especially from the beginning of the 1990s that include the deregulation of interest rates, loan classification, and provisioning requirements, adoption of indirect and market-oriented monetary policy instruments, strengthening the operations of the banking system by improving the legal environment, making taka convertible and computerization of bank branches. All the reforms brought mixed forms of changes in the banking sectors in Bangladesh.

The major objectives of the study would be i) to evaluate the nature and characteristics of lending risk analysis followed by the State Owned Commercial Banks (SCBs) in Bangladesh and ii) to judge the effectiveness of their practices on the performances of these banks in terms of p, profitability, liquidity, productivity, trends of recovery of loans, size, and nature of non-performing loans and iii) The study also aims to diagnose the root causes of the loan defaults and focus on some suggestive measures to improve the eroding situation in healthy management of credit of the SCBs as well as of the banking sector as a whole.

The study is based mainly on secondary data, generally from the published reports of Bangladesh Bank, commercial banks of all categories, and other relevant organizations pertinent to the study from 1993 to 2012. In measuring the performance, comparative analysis among different categories of Banks like SCBs, PCBs, FCBs, and DFIs, have also been done. The research has been analyzed based on qualitative and quantitative phenomena.

The statistical techniques that have been used are: Central Tendency, Standard Deviation (SD), Coefficient of Variation (CV), Growth Rate, Log-Linear Model for growth rate, Correlation, Regression Analysis, ‘T’ test, ‘F’ test, ANOVA, etc., and the hypotheses have been tested through the aforesaid tools and techniques. In the case of financial tools, Ratio analysis, Funds flow analysis and Trend analysis have been done. From the analysis, it has been found that among the three types of banks, SCBs earned the lowest income compared to other categories during the study period.

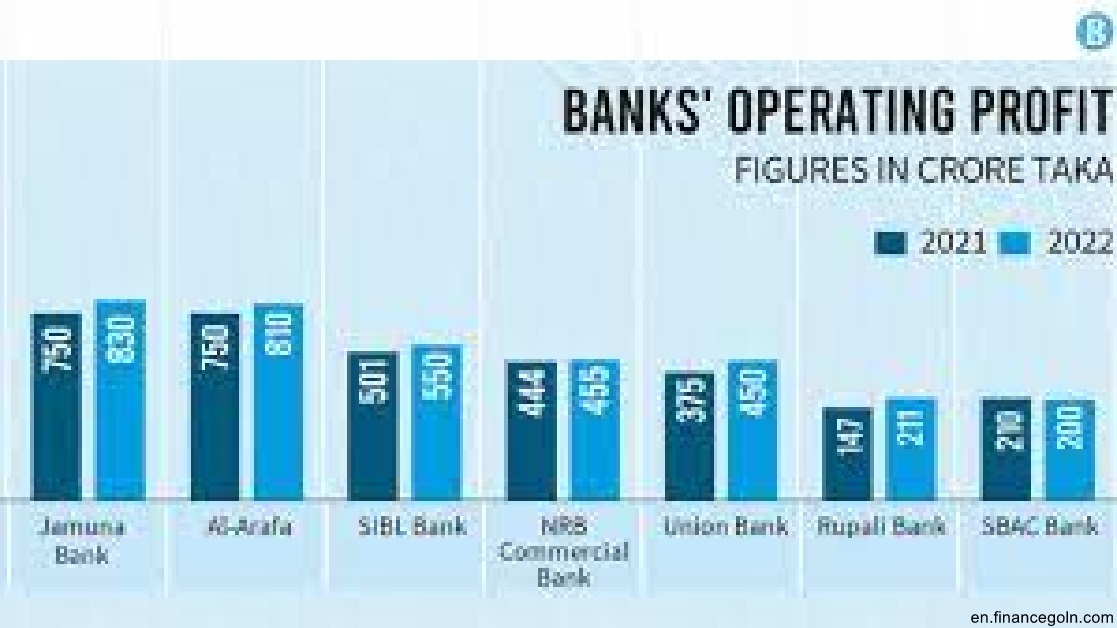

On the other side, FCBs were in the top position in terms of income position. The growth rate of income of FCBs and PCBs was much more than that of SCBs. FCBs have minimum manpower compared to SCBs and PCBs. SCBs are in the top position in the case of manpower position from 1994 but the growth rate became decreased from the year 2003. FCBs maintained a good amount of capital compared to their risk-weighted assets than the PCBs.

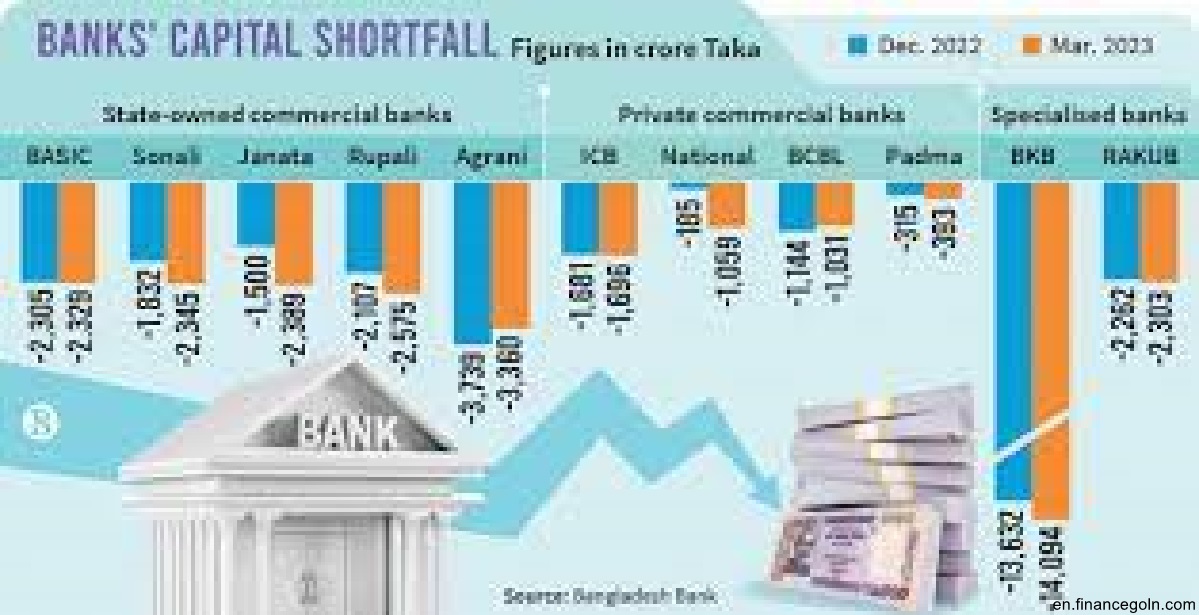

SCBs were third in that race followed by the DFIs. Amount of NPLs of the SCBs decreased from Taka 117.3 billion in 2000 to Taka 107.6 billion in 2010 and again it rose to tk. 132.7 billion in 2102. The PCBs recorded a total increase of Taka 18.1 billion in their NPL accounts, which stood at Taka 64.3 billion in 2010 as against Taka 46.2 billion in 2000. In the case of quantitative evaluation of the selected State Owned Banks (SCBs), we experienced a mixed nature of picture in different parameters of performance among these four banks.

There was no stable patBank in any area of the activities of these banks. We found that Sonali Bank had the maximum volume of outstanding, classified, substandard, doubtful, and bad/loss loans among the others during the study period. This is not only in terms of magnitude but also in terms of average and growth rate. Other pictures were also not satisfactory except in some areas ia n isolated ways. In some cases, Janata Bank and Rupali Bank represented a better scenario than those of Sonali Bank and Agrani Bank.

For example, the interest income oviewpointSCBs showed a positive trend during the period. Both from the viewpoint of objective and subjective analyses, it was found that the State Owned Commercial Banks (SCBs) of Bangladesh are especially challenged by many problems including crisis inefficient risk, and management, high default rates leading to increasing non-performing loans, and deteriorating customer service standards.

An alarmingly high rate of default, especially of willful default, has put undue pressure on banks’ capability to increase investment and/or reduce lending rates despite high profile demand for such promotional intervention of the banks to boost up the economy based edit Risk Analysis and selection of investment proposals based on sound financial merits are the preconditions of good recovery of credit funds as well as the sustainability of the lending banks.

But the real situations depict a poor analysis of lendidebt-equityherent in loan projects, flawed credit delivery system, high debt-equity ratio, delayed credit disbursement which, and inappropriate loan repayment installment due to poor supervision, are the common scenario of the banking sector, particularly the SCBs are the worst affected ones.

The major findings of the study through testing the hypothesis is that there is a strong relationship among net profit (nonperforming (ti), NPLt, al expense (te), capital adequacy ratio (car), nonperforming loan (NPL), and return on equity (rothe e) of SCBs and it shows a significant correlation between net profit as the dependent variable and all other her variables above as independent ones.

The test result suggests that the net profit of the SCBs as a whole can be well explained by those factors i.e. if Total income, Return on equity, and Capital adequacy ratio increase then obviously, these will have a positive impact on the Net Nonperformingbank and vice versa. On the other hand if Total expenses, Nonperforming loan size increase then these will have an adverse impact on the profitability of any bank. Moreover, it has been found through tests that efficiency lending risk varies within different units of SCBs.

Using the Log –Lin model for predicting the future growth of Net Profit After Tax (NAPT) of the SCBs, it has been found that in the aggregate, all the SCBs are expected to have negative NPAT in the future. In the same way, through time series analysis we also get a very dark picture of these banks when we find that their predicted classified loan amount also shows a positive growth over the coming years individually in large bulks.

These are all very alarming for the sustainability of such banks. It has been observed that efficient credit risk analysis and selection of investment proposals based on sound financial merits are the preconditions of good recovery of credit funds as well as the sustainability of the lending banks. Due to ignorance and insincere commitment on the part of the bank officials, the loan proposals are not properly investigated. So, weaknesses remain in the appraisal and selection process of loan projects which ultimately end as sick ones.

Moreover, political and undue interference in loan sanctioning and repayments, Diversion of credit funds in nonproductive sectors, and poor follow-up and monitoring in post loan sanctioning stage are other reasons behind the distressed conditions of SCBs. As policy prescriptions, the SCBs can be cured from the grip of bad/loss loan situations, if banks can strengthen the credit risk management area by equipping their manpower with sophisticated training, or can resort to the service from expert and independent professional firms for scientific and authentic appraisal of loan proposals. Nevertheless, the passing of the Financial Reporting Act is an essential requirement in this regard to get transparent information from the borrowers’ end.

The SCBs’ loan recovery units also should be reorganized with target-oriented motivational packages. SCBs have to be freed from the curse of double supervision of the Ministry of Finance and Bangladesh Bank. They should be under the direct control of the central bank for effective supervision. All the above devices can protect the SCBs from poor lending performances and can also contribute towards sustained profitDepartment those banks.

Description:

Universityrtation submitted to the Department of Banking and Insurance, University of Dhaka in partial fulfillment of the requirements for the degree of Doctor of Philosophy.